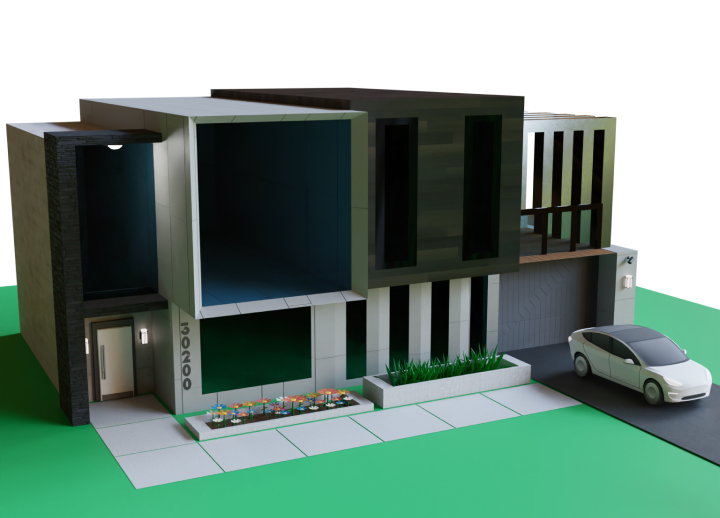

Let’s Open The Next Door Together

Get great advice, loan programs and support from a team with a proven track record of 5 star reviews.

Join the neighborhood

How it Works

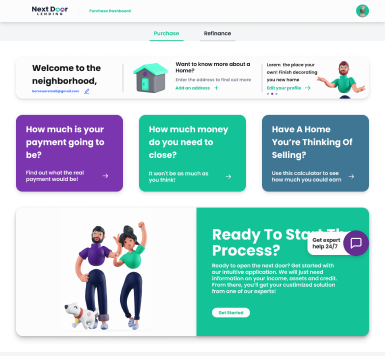

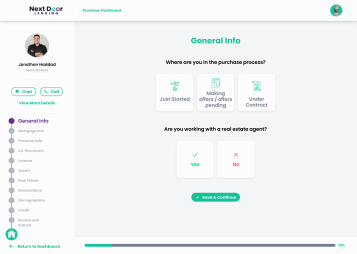

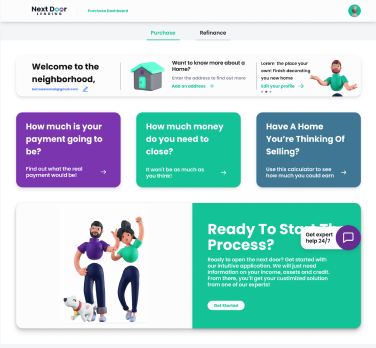

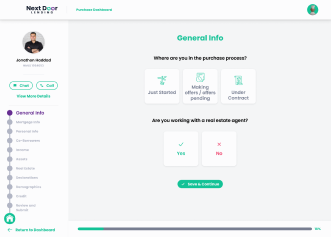

Get started by entering your email, and once verified, you will receive a magic link to login in without the hassle of creating another online account. Then instantly access various financial calculators and resources to help you and your family understand the mortgage process. Have the confidence to complete an interactive application at your pace without making a single phone call.

The Keys To Next Door

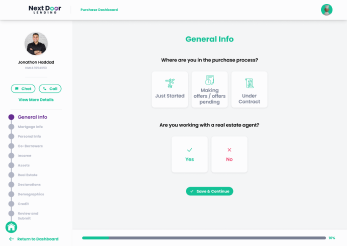

Customize Your ProcessChoose your preferences to create an efficient process tailored to your life.

Customize Your ProcessChoose your preferences to create an efficient process tailored to your life.

Get Neighborly AdviceFull access to our experts to analyze your situation and guide you to a solution with certainty

Get Neighborly AdviceFull access to our experts to analyze your situation and guide you to a solution with certainty

Own Your ExperienceUtilize our tools and resources to create a lending experience focused on you and your goals

Own Your ExperienceUtilize our tools and resources to create a lending experience focused on you and your goals

Meet The NDL Family

We’d like to introduce you to our team of highly skilled experts ready to help guide you through the mortgage process

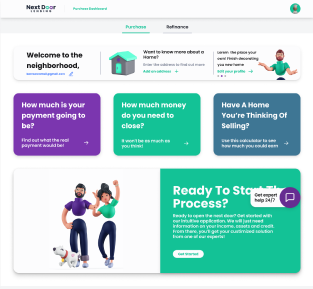

Purchase

We offer a full library on the purchase process, programs and mortgage terms so you can educate yourself before starting the homebuying process Get personalized updates and full transparency through every phase of the purchase process from accepted offer to closing

Refinance

Find out if refinancing is right for you! Whether you're looking to take cash out, pay your home off faster, or save money. Never have to pick up the phone by using our interactive calculators and resources to figure out what makes the most sense for you and your family. Visit our refinance page to learn more.

Reviews

1294 Reviews

See what our neighbors are saying about us!

My experience with this company was absolutely fantastic! I can’t say enough great things about Salem, George, and Klara—they made the entire process seamless and stress-free. Their professionalism, attention to detail, and genuine care for their customers truly set them apart. From start to finish, everything was handled with efficiency and expertise. I will definitely be working with them again in the future. If you're considering this company,...

AmeliaMarch 18, 2025

I almost didn’t answer the phone…..I’m so glad I did!! I had already started a re-fi with my bank, but the moment I started speaking with George, I had a good feeling about switching to Next Door Lending. I was immediately impressed with his knowledge and willingness to help me find a better solution to my re-fi needs. First of all, it was a Sunday when he called, and banks are always closed on weekends and holidays, but not this company. It seem...

DaisyMarch 4, 2025

Emma Stewart at Next Door Lending is outstanding! She is making the loan process incredibly smooth and stress-free, always taking the time to explain everything clearly. Her expertise and dedication to finding the best options truly set her apart. Emma is responsive, professional, and genuinely cares about her clients’ success. If you’re looking for someone you can trust to guide you through the lending process with confidence, Emma is the one to...

CameronFebruary 22, 2025

Read from over 300+ 5 star reviews

Resources to help you

We believe that an educated decision is the best one! That means our blogs, mortgage terms, and all other resources are available to everyone in our neighborhood, free of charge.

Mortgage Terms

Find out if refinancing is right for you! Whether you're looking to take cash out, pay your home off faster, or save money. Never have to pick up the phone by using our interactive calculators and resources to figure out what makes the most sense for you and your family. Visit our refinance page to learn more.

Loan Programs

The mortgage industry is constantly evolving and is no longer tied to just a 30 year and 15 year fixed. Check out all the different programs and see what may work best for you and your family.

Blogs

Whats new around the neighborhood

Want more education on mortgages and financial literacy?