Get started with Refinancing

Join our family by simply entering your email. In return, you will receive access to our custom dashboard filled with interactive calculators and resources to help educate you or your family about the mortgage process.

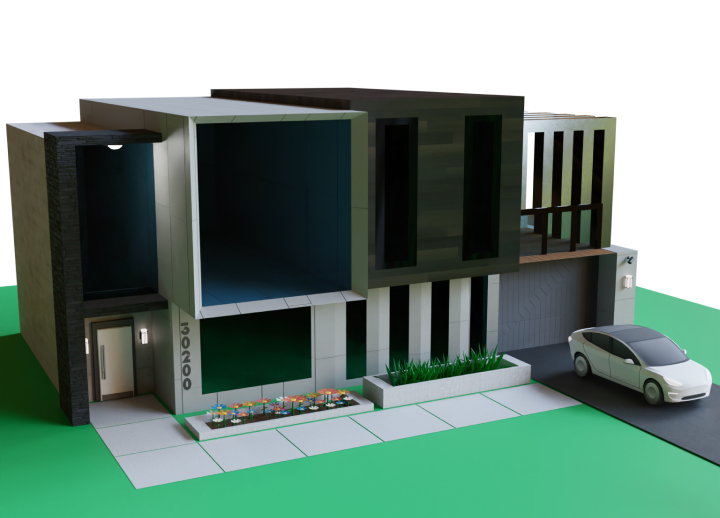

Thinking about refinancing?

These things matter to us when it comes to finding you the right home

How Much Can I

Save?

Save?

At Next Door Lending, our personalized dashboard offers the tools to calculate potential savings with a refinance. Join our familly now to find out!

How Much Cash Can I Get?

Utilizing our dashboard, find out how to leverage the equity in your home to help you get ahead!

How Fast Can I Pay Off My Home?

Within our dashboard, create a timeline to pay your home off faster. The potential savings will surpise you!

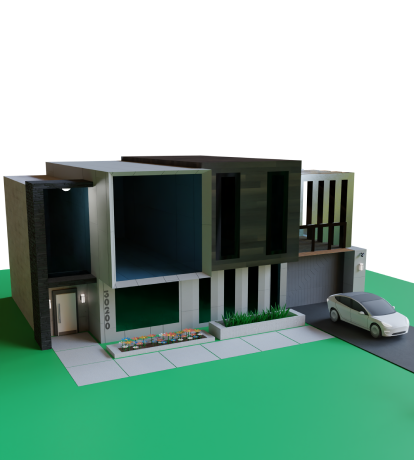

What does refinancing look like?

Here is an insight into the typical refinance process

1

Research options

Use our dashboard to explore the benefits of refinancing your home!

2

Submit your documents

Utilize our intuitive systems to upload your informationand streamline your refinance process!

3

Underwriting

Our team of experts will make sure your information is processed seamlessly to get you approved!

4

Closing!

Leveraging our dashboard, we give you real time updates that track your mortgage process all the way to closing!

Want to learn more?

We offer a wide variety of resources from blogs, video content and mortgage terms to help educate you on the purchase process.

Want more education on mortgages and financial literacy?

Mortgage Terms

Fixed Rate Mortgage

A fixed-rate mortgage is perfect for anyone that wants stability or certainty when it comes to their finances. With this loan, we know exactly how much our monthly payment will cost us thanks to its static interest rate. This type of loan also helps with being able to accurately plan out what amount we need saved each month so that there's no surprises down the line should interest rates rise unex.....

Purchase Agreement

When buying a home, the purchase agreement is an important document that outlines all of the necessary information for transferring title. The contract includes details about things like price and down payment requirements as well as contingencies to protect both parties in case something goes wrong with financing or other issues arise during closing.

Wanna Learn

more

mortgage

terms?

more

mortgage

terms?